Tax Exemption

In these complex times, what we seek is to achieve more benefits at a lower cost, which is why on this occasion we provide you with relevant information on one of the great advantages of belonging to a Free Trade Zone.

Law No. 32 establishes that a Free Zone is an area physically delimited and subject to a special fiscal, labor, immigration and customs regime; dedicated to the production, processing, added value and marketing of goods for export and/or domestic supply, as well as the provision of services related to international trade.

Panapark is the largest private Free Trade Zone in Panama and is committed to facilitating the trade of countries, which thanks to tax, customs, immigration, labor and financial advantages, has positioned itself in the world economy through investment, vision towards technological, economic and social development.

Once you begin to carry out operations within Panapark, you become a creditor of income tax exemption, due to operations abroad. A sales tax exemption equivalent to 7% ITBMS is also provided exclusively for material goods.

The exemption from taxes and import duties is given on raw materials, semi-finished products, purchase and import of equipment and construction materials, as well as machinery, spare parts, tools, among others.

By being part of Panapark, you can pay 0% income tax, taxes on the transfer of material goods and services (ITBMS), import taxes, customs duties, property taxes, transfer of import and export goods.

We emphasize that within the Free Zone you can carry out activities of Manufacturing, Assembly, Processing of finished or semi-finished products, Environmental Services, General Services, Logistics Services, Higher Education Centers, Scientific Research Centers and specialized Centers for the presentation of health services.

Logistics Diagnosis of the Supply Chain

The supply chain is perhaps the most important factor in the operational process of companies. Its correct operation can bring different advantages such as the minimization of production and logistics costs, allowing the company to control the quality of its products and also, it can have relevant information to make decisions and implement the necessary measures according to the identified needs.

In order to know the supply chain state chain and to know if its operation is being efficient, it is necessary for companies to constantly carry out a logistics diagnosis at each of its stages. It is important to set measurable goals in advance that adhere to the best known practices, in order to be compared with the results of the diagnosis.

The logistics diagnosis should help prioritize the logistics strategy. Knowing in advance that resources are limited, managers are obliged to allocate them in the best way to obtain greater benefits from operations. It is important that the diagnosis is carried out in different stages, beginning by defining the strategy that will be developed, including the administrative and demand planning spheres. Then, the production process must be clearly defined, including the supply and handling of raw materials. Subsequently, it is imperative to analyze and decide which will be the distribution channel and the product transportation, at the same time, specify the required storage mode according to the characteristics of the product. Finally, the process must be closed by establishing what will be the best method to provide excellent customer service.

It is possible to carry out the diagnosis following the guidelines defined in the good practices. This is a good method, because these standards have already been approved and guarantee good long-term results. However, there are different ways to do it, another one is to resort to financial or benchmarking reports.

As the logistical diagnosis is made, the process must be documented. At the end, it is necessary to prepare a report containing all the information acquired during the diagnosis. In addition, it is advisable to include a series of proposals to improve the logistics strategy at each stage of the supply chain. This entire process must be directly focused on generating added value that must be transferred to the client and the company’s shareholders.

E-Commerce and Free Zones

It is indisputable that the purchasing habits of the general population, worldwide, have changed in recent years. Now, the consumer has reduced the gaps in accessibility and use of new technologies, as they have acquired greater confidence in the use of virtual channels. The new trends in national and international trade are mainly oriented towards electronic commerce. Digitization has forced companies to evolve their customer service and the way in which they distribute their products and services. There are two fundamental actors involved in the logistics chain to achieve this type of trade, these are: International Logistics Distribution Centers and Free Zones.

Currently, the countries of Latin America are preparing to effectively develop this new business model. In several countries, new regulations have already been established in order to attract large virtual retail platforms, and thus potentiate the area as an efficient logistics hub.

With this new technological commercial boom, the Free Zones have the obligation to reinvent themselves, since they represent an essential link in the process of online transactions, thanks to their possibility of optimizing the costs that interfere in the logistics chain. Now, they will have the opportunity to expand their portfolio of services, taking into account that the operations to which the goods are generally subjected must become more efficient; considering how quickly deliveries must be met in a digitized world. Some of these operations are related to packaging, repackaging, cleaning, laboratory analysis, labeling, improvement or conditioning of the presentation, among others.

However, it is still necessary for the states to formulate legislation and regulations that reduce the processes, opening the possibility that the procedures are easier and more simplified. Also, it is imperative to adapt the legislation of the Free Zones, so that dispatch logistics can be carried out for small quantities of products when they are sold through e-commerce. We must take advantage of e-commerce to achieve international standards, considering that it has become a great driver of global economies.

E-commerce plays a very important role when it comes to generating competitiveness in SMEs, as it provides greater communication facilities between companies and consumers, allowing them to know in advance the needs and demands of the market, so that companies can satisfy them in an efficient way. more effective. Additionally, it allows customers to make small-quantity purchases, which sellers can ship through postal traffic or express delivery shipments.

The great advantages of physical and technological infrastructure must be taken advantage of for the export and import logistics processes that the Free Zones possess, since in this way they are able to generate efficiencies and economies of scale according to the demands of the new online consumption habits and offline.

Finally, it is important to emphasize that e-commerce in Free Zones not only covers product logistics, but also includes the service industry. Now, many service companies, such as call centers or data centers, are establishing themselves in the Free Zones, taking into account all the advantages mentioned above. This will provide greater competitiveness to the regions, since more employment will be generated, necessary to meet the high demands generated by a digitalized and even more globalized market.

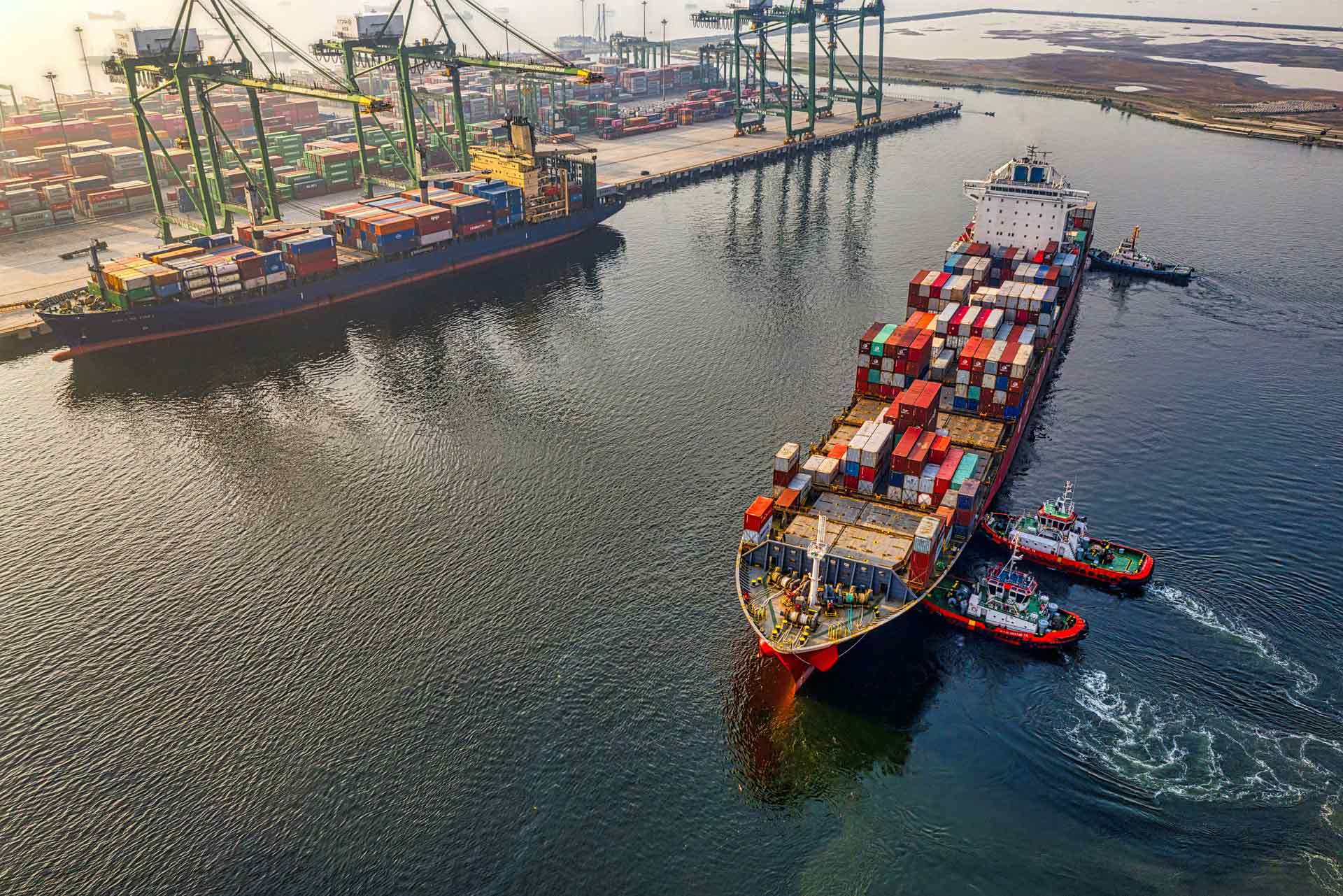

The Logistics Challenges of the Central American Countries

During the last five years, Central American countries have increased their investments, both public and private, in order to attract more shipping companies to the region, and with it more trade and economic growth. Thanks to its geographical location, a clear competitive advantage, this region has access to two oceans, being the main trade route of the American continent. Through the oceans of this isthmus, approximately 80% of the merchandise is transported.

The country with the most visible logistics development in that region is Panama, followed by Guatemala and then by Costa Rica. In 2018, the World Bank ranked Panama in 41st place worldwide, according to the Logistics Performance Index, in addition, it is the second in Latin America and the Caribbean. Within the aspects evaluated to define said index, are: infrastructure, customs, competence of logistics services, tracking and tracing, among others.

The arrival of Industry 4.0 has forced these countries to increase their investments in improving infrastructure, incorporating new technologies and attracting more shipping companies; this with the aim of achieving better performance in the functions of loading and unloading ships in ports, being more competitive in terms of rates and maintaining stable communication between all the actors in the logistics chain.

However, despite the fact that several ports in Central America have achieved an acceptable performance in their functions, there are still many challenges that must be faced to guarantee an efficient result in their processes. Some of these challenges are related to the articulation between actors, the organization of the port community, the relationship with the city and the customs union of the region. The latter is perhaps one of the main points to consider, since customs have taken on a supervisory role with a special purpose in collecting taxes, relegating trade facilitation to the last instance. It is important that this entity acts efficiently by developing proposals focused on improving its processes, minimizing costs and time in procedures, allowing companies to achieve greater benefits from their commercial transactions.

On the other hand, the countries located in Central America have recently become strategic partners of the North American market, because thanks to their geographical proximity, their time similarity, their excellent air and sea connectivity and their highly qualified workforce, many of the operations of American companies have relocated to these countries, making use of nearshoring. On this issue, the leading country in the region is Costa Rica, as it is the one that has managed to capture the largest flow of foreign direct investment with the relocation of three companies to the country.

However, several experts have recommended that the region be sold as one, taking into account the needs of the interested investor or company, unifying efforts to present the value chains that Central America has, taking advantage of the CAFTA (Free Trade Agreement) Trade between the Dominican Republic, Central America and the United States of America) and the free zones that these countries have.

To achieve this position, it is necessary for state governments to review the obstacles to trade that still prevail in the region. Investments must be promoted and bureaucratic policies that reduce the effectiveness of internationalization processes must be eliminated, allowing them to be streamlined electronically. In addition, regulatory frameworks must be strengthened in order to provide greater legal certainty to investors.